Zakarpattia’s unique characteristics are often exaggerated, yet they are quite clear regarding any area of life. For instance, while a group of Zakarpattia’s smugglers is transferring several packages of cigarettes from Ukraine through the unguarded sections of the Romanian, Hungarian or Slovak border, new “Škoda” cars are being assembled at the plants of Zakarpattia, new coffee machines Nespresso are being produced just as hockey sticks for NHL and almost a half of all skis and snowboards that are imported to the EU. Also, Zakarpattia is home for designer furniture for Starbucks and carbon spare parts for BMW, Audi, Porsche and Mercedes. At some of the plants people are working along with robots.

The only unjustness about this grotesque situation mentioned above lies in the unsavory reputation of Zakarpattia’s smugglers having turned into “a negative brand” of the region. Way fewer people have heard about high-tech production there with even fewer being aware of any further details.

It is for this reason that Ukraine’s westernmost region, which borders on the EU, may invoke a misconception in terms of its opportunities for investment and business.

“The black hole in the centre of Europe”, that is exactly the metaphor that the then US State Secretary, Madeleine Albright, used describing Slovakia. Unfortunately, nowadays it applies to Ukraine and, in particular, to Zakarpattia that hosts Europe’s actual geographical centre.

However, 6 years after that statement Slovakia managed to top the list of reforming countries according to the World Bank ratings “Doing Business”. In the subsequent years, entirely different adjectives were used when referring to Slovakia. Instead of being “the black hole”, it transformed into “the tiger from the Tatra Mountains”, or “European Detroit”, or “the wonder on the Danube”.

In other words, the country managed to get rid of its unpleasant nickname and to acquire the status of “a new investment wonder” in the matter of a few years.

Despite the unfavorable current situation, Zakarpattia possesses all needed prerequisites to follow in Slovakia’s footsteps, becoming something of an investment ‘stepping stone’. Here is why.

An investment wonder unknown to many

“Let me show you some figures. During 2001-2004, a total of 19 thousand jobs were created in Zakarpattia, 8 modern “green-field” enterprises were founded with over 30 having been modernized, 200 million USD of direct investment were attracted, the external trade turnover raised from 342 million USD in 2002 to 1,3 billion USD in 2005”, – says Volodymyr Panov who at the Zakarpattia state administration was responsible for attracting investment to the region of Zakarpattia in 2001-2004.

However, according to Mr. Panov, everything depended back then not on him or the local authorities, but on the central government. It was the government that passed a few bills in the period from 1998 to 2001 that saw the establishment of 11 special economic zones and 9 territories of priority development enjoying the special mode of investment activities, in particular, the special economic zone called “Zakarpattia”.

“Our region did not enjoy any privileges or preferences that would have helped us attract investors. We had access to the standard set of opportunities offered by any other special economic zone, such as the customs zone at the facilities, tax privileges, etc. What Zakarpattia did was to make use of those opportunities that were offered at that time by legislation and investment environment”, – says Mr. Panov.

Volodymyr Panov also says that this was no “investment miracle” yet, merely a prelude. The miracle would have happened, had the state effectively not cancelled all previous privileges for investors in 2005 and refused to deliver on the guarantees it had given the investors.

According to Mr. Panov, such world giants as IKEA, VW, Greisinger, Toyota, Philips, Sumitomo, Bosch, Braun and Siemens were seriously considering an opportunity to install their production capacities in Ukraine and, particularly, in Zakarpattia. ‘According to my evaluations, we are talking here about 1,5 billion USD of direct foreign investment that we never received’.

Nevertheless, foreign investment continues to work for the good of the region, even expanding its production activities.

A life without privileges

During 2018-2019 Jabil and Flex, which rank among the leaders of contract electronics production, have effectively doubled their production capacities in the region. Flex has established a new production line that has created another 1000 jobs. The company is also intent on doubling its general production capacities that would mean increasing the floor space from 24 thousand square meters, which is now taken up by its factory in Mukachevo, to 55 thousand square meters. Jabil has expanded its floor space by another 20,7 thousand square meters, having increased the number of jobs from 3 to 5 thousand and invested 16 million USD into new production capacities.

The EuroCar plant, located in the village of Solomonovo right on the Hungarian border, is now the main centre of the automobile industry in Ukraine. It is this plant that is producing the biggest number of cars in the country. In 2019 it was practically the only plant in Ukraine that was producing cars uninterruptedly.

Besides the point, since the plant was launched in December 2001, EuroCar has been effectively producing the whole Škoda’s line of cars – Roomster, Rapid, Fabia, Octavia, Superb, Kodiaq, Karoq, as well as some cars of Seat – Leon, Toledo Altea, VW and even Audi.

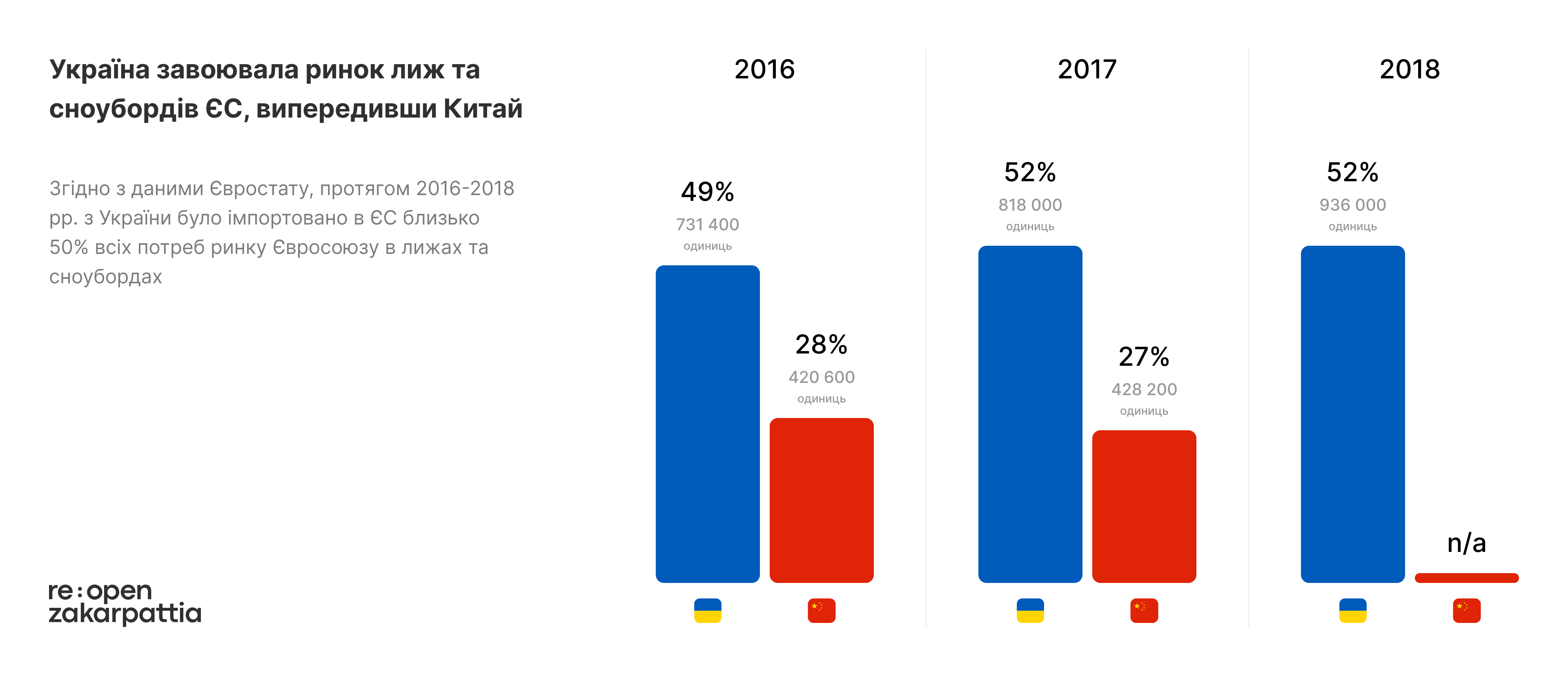

Despite the pandemic, Fischer’s factories have not ceased to modernize and expand its production in Mukachevo. The company produces about a million skis annually, which satisfies half of the demand in skis in the EU.

By this parameter, Ukraine has ranked among the world’s leaders for the last 3 years, even ahead of China. All this is possible thanks to the Fischer factory in Mukachevo.

Fischer constitutes an unprecedented example that, on the one hand, can hardly be repeated. On the other hand, it proves that Zakarpattia could be Ukraine’s investment gate in spite of all legislative turbulence and other vicissitudes.

‘The Ukrainian-Austrian company was established at the premises of the former Soviet ski factory. First, in the middle of the 1980’s the factory purchased the technology of ski production from the Austrian company “Fischer’, which had been founded in 1924. In 1995 a joint enterprise was established that now hosts the key production capacities of the world’s leader in ski production with the headquarters in the Austrian town of Ried, says Vasyl Riabych, head of the Mukachevo’s factory.

Here are 5 quick facts about Fischer’s factory in Mukachevo:

- About a million skis and hockey sticks are produced at the factory on an annual basis, i.e. 4 thousand pairs of skis and hockey sticks are produced daily.

- Overall, about 150 ski models are produced there, 120 of which are cross-country skis.

- The production is exported via a logistics centre in Austria to almost 50 countries, including Japan, Canada and the USA.

- Fischer’s hockey sticks are mainly exported to the USA and Canada. Most of the NHL players use them.

- The only golden medal for Ukraine at the Winter Olympics was won by the freestyle skier Oleksandr Abramenko, who used the “Tysa” skis produced at the Mukachevo factory.

A breakthrough in new settings

Within the framework of the forum Re:Open Zakarpattia in November last year a separate panel discussion took place on how the investment wonder in Zakarpattia of the early 2000’s could once again be brought about.

The participants of the discussion mainly agreed on the fact that as of today Zakarpattia in particular and Ukraine in general have lost their advantages of cheap energy sources and labor force that they had at the beginning of the 2000’s. The country and the region are still facing risks in the form of corruption, unprotected rights for private property due to the judicial reforms that have not been implemented. The question of reestablishing privileges for investors is once again on the agenda (basically, a proposal for renewing the status of a free economic zone within the Zakarpattia oblast as a pilot project that can subsequently be implemented in other regions of Ukraine).

The alternative could also lie in providing the investors with privileges not within the regions, but within the framework of development of industrial parks.

Ukraine’s Western neighbors, such as Slovakia and Hungary, have also followed the way of offering direct state help or infrastructural assistance to big investors so that they could expand their production capacities and create more jobs.

It is worth considering the fact that in 2009 Hungary paid Mercedes 22 billion HUF (61 million EUR) for the construction of its new factory Kecskemét, where a lot of Zakarpattians work. The country paid another 13 billion HUF (36 million EUR) for the construction of the second factory in 2016. BMW will receive from the Hungarian government 12,4 billion HUF (34,4 million EUR) of direct state assistance for the construction of a new plant in Debrecen, located close to the Ukrainian border. This sum does not include state investment into the development of the infrastructure in Debrecen, new railroads and automobile roads.

Apparently, Ukraine can’t afford such direct subventions even theoretically. However, the development of the infrastructure in the regions could considerably boost the attraction of privileges for investors.

In Zakarpattia such development could have a multiplying effect, as this region, on the one hand, enjoys an unprecedentedly favorable geographical location, and on the other hand, has a good premise for logistics development.

Thus, the Zakarpattia oblast borders on 4 EU-countries. It has 3 truck border crossing checkpoints with 3 of them. At the same time, not a single border crossing checkpoint has been opened in the last 10 years, whereas the new 18 ones are currently being planned. It would be advisable to open at least 4 checkpoints in the next few years and modernize the existing ones – “Tysa” and “Luzhanka” on the Hungarian border, @Uzhhorod’ on the Slovak border and “Dyakovo” on the Romanian border in order to boost their truck flow rate.

Provided new high-speed trains are running in both directions from Lviv and Kyiv to Debrecen, Budapest, Košice and Bratislava and the airport in Uzhhorod is ‘resuscitated’, the results will not be long in coming.

Also, as Ivan Mikloš pointed out while sharing experience from the Slovak investment wonder, the communication with the world and potential investors is crucially important.

In other words, today it is vital to convince others drawing on strong arguments why Zakarpattia is not a region for smuggling and smugglers, mobs and gangland feuds, but a unique multicultural region in the centre of Europe capable of becoming Ukraine’s new success story.

Dmytro Tuzhanskyi is director of the Institute for Central European Strategy (Ukraine)